HOW

TO RETIRE HAPPY

Retirement With a Difference

|

||||||||

Retirement Calculators to Help You Determine Your Required Retirement Savings |

| a) Savings at retirement | $765,768.94 |

| (b) Required savings at retirement | $1,831,653.04 |

| (c) Difference | $1,065,884.10 |

| (d) Additional annual savings | $176,884.22 |

Most major financial institutions offer retirement calculators as a means of trying to attract business through their websites. Aside from the retirement calculators offered by the major financial institutions, there are many others that you can utilize. Here are some of them:

Choose To Save: Created by the Employee Benefit Research Institute, this financial website offers savings tips, retirement calculators, and links to retirement resources to help you plan your retirement.

Yahoo Finance Retirement Tools: Offers retirement information and a variety of retirement calculators to help you with your retirement planning.

Social Security Estimator: For Americans: On this government website you can estimate your future Social Security retirement benefits at different ages using different future earnings projection.

Should You Use a Financial Planner

Sixty-seven percent of retirees in a recent Bank of America survey said they don't work with a financial adviser for retirement planning. Fifty percent of non-retirees said they use a financial adviser and 44 percent said they intend to work with a financial adviser to determine how to increase their financial assets when they retire.

One of the biggest problems with the financial planning industry is that any salesperson can call themselves a financial planner or a financial adviser and most do. Near as I can tell, it doesn’t take much to get a business card that says, Financial Planner.

Indeed, during the great recession, many people have turned to careers in financial planning, a number who are likely themselves broke due to mishandling of their own finances. Needless to say, you don't want to use one of these "financial planners' to advise you on how to save your money and spend your money.

What you may want is a financial planer with a CFP designation. CFPs distinguish themselves because they must have a minimum of three years experience in the field, have passed a rigorous slate of exams to receive certification and are obligated to uphold ethical standards. Only about a quarter of financial planners have CFP distinction.

Two additional popular qualifications you might see are the CRPC - chartered retirement planning counselor - held by those who specialize in retirement planning, and the ChFC - chartered financial consultant - held primarily by insurance specialists who have studied and practiced financial planning.

Last, a certified public accountant (CPA) could also be a used as personal financial specialist if he or she has had additional financial planning education, or a CFP.

Perhaps You Should Use Advice from Retirees Instead of Advice from a Financial Planner

Interestingly, a majority of wealthy Americans said they are concerned that they won’t have enough retirement income to last through their lifetimes, according to a 2010 Bank of America Corp. survey. This is the new retirement, apparently.

The BOA survey said 53 percent are concerned about making sure retirement assets will last. Fifty-nine percent of retirees also said rising health-care costs are a concern. More than half of non-retired respondents made some adjustments to their lifestyles last year, such as spending less on personal luxuries or giving less to charities, and 29 percent said they expect to retire later than originally planned, the study said.

Perhaps retirees can provide valuable retirement planning advice to these wealthy individuals and to us, which is all that we need, without having to hire a financial advisor.

In a recent survey conducted on behalf of Merrill Lynch Global Wealth Management, retirees were asked where they would recommend those within ten to fifteen years of retirement focus their attention on retirement planning and where those more than fifteen years from retirement should be focused:

Within Ten - Fifteen Years of Retiring:

- Create a retirement plan around what is most important to you (51 percent).

- Have a retirement plan to manage income throughout retirement (47 percent).

- Pay down debt before retirement (40 percent).

- Account for unexpected costs and risks such as health care, cost of living and/or market fluctuations (38 percent).

- Pursue home ownership (24 percent).

- Be cautious of taking investment risks (21 percent).

More Than 15 Years Before Retiring:

- Create a retirement plan around what is most important to you (43 percent).

- Pay down debt before retirement (41 percent).

- Have a retirement plan to manage income throughout retirement (39 percent).

- Account for unexpected costs and risks such as health care, cost of living and/or market fluctuations (38 percent).

- Work with a financial advisor if you don't already (25 percent).

- Pursue home ownership (25 percent).

No doubt if you follow the financial advice of these retirees, you willl do okay. Again, as J.P. Getty said, "People who don't respect money don't have any."

One week into retirement, you'll be so damned bored that you'll want to stick bicycle spokes into your eyes. You'll probably opt to look for another job or start another company. Kinda defeats the purpose of waiting [for retirement], doesn't it.

— Timothy Ferris in The 4-Hour Workweek"It [retirement] was absolutely boring. You can't go and say, 'I'm retired now. That's it!' It won't take long and you're really gone for good and someone throws the last shovel of dirt on a coffin with your name on it. That's the moment you're really retiring — when you die."

— Ozzy Osbourne

What Sort of Legacy Will You Leave to Your Children

and Grandchildren?

Will Any of These Be Your Retirement Story?

- Retired at 60 and vegetated until he died at 68!

- Retired at 65 and watched 10 hours of TV every day for the rest of her extremely boring life!

- Took early retirement and lost all her retirement savings at the casino because she didn't know what else to do with her time!

- Retired early, got extremely bored, and then tried to return to his old job that he hated, couldn't get it back, found a job that he hated even more, and had to retire again because of poor health!

It Doesn't Have to Be That Way!

Make the most important investment that you can make for your retirement right now:

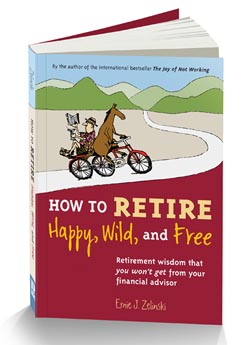

Purchase How to Retire Happy, Wild, and Free Today:

Purchase

How to Retire on

Amazon.com

Purchase

How to Retire on

Amazon.com

Copyright 2022 by Ernie Zelinski,

All Rights Reserved

|

A gold watch is the most appropriate gift for retirement, as its recipients have given up so many of their golden hours in a lifetime of service.

— Harry Mahtar

The requirements for successful retirements

are, of course, simple to map out: Begin saving earlier in life, set aside larger

percentages of your pay, invest wisely in low-cost funds, avoid debt, pay off

your mortgage, defer Social Security to boost payouts, and work past traditional

retirement age to make sure you don't run out of money. Stay healthy, too, so your medical expenses don't eat you alive.

We might as well complete this fairy tale by advising you to make sure you find a job with a traditional pension, and

to only work for employers with AAA credit

ratings and great health insurance.

— from US NEWS

Sometimes it's important to work for that

pot of gold. But other times it's essential to take time off and to make sure that your most important decision in the day simply

consists of choosing which color to slide

down on the rainbow.

— Douglas Pagels

OVER 425,000 COPIES SOLD

Purchase:

How to Retire Happy, Wild, and Free on Amazon.com

and

How to Retire Happy, Wild, & Free on B&N.com

Everyone needs a reason to put their shoes on in the morning [when they retire]. If you put on the slippers, you'll end up

dragging your feet all day.

— Norma Fagan

OVER 315,000 COPIES SOLD

Purchase:

The Joy of Not Working on Amazon.com

Whatever the challenge of a new age, in the end what really counts is not the years in our lives but the life in our years. It is not about longevity, but the depth of life. Long ago I learned that age does not wither the mind if people remain positive. No one is too old to set another goal or to dream a new dream. It is a mind game. As Churchill suggested, "The empires of the future are the empires of the mind."

— Singapore Retiree Jennie Chau

A CAREER BOOK FOR RETIREES WHO WANT TO WORK IN RETIREMENT BUT NOT IN CORPORATIONS

CAREER SUCCESS WITHOUT A REAL JOB

Purchase:

Career Success Without a Real Job on Amazon.com